CA SC-140 2007-2024 free printable template

Show details

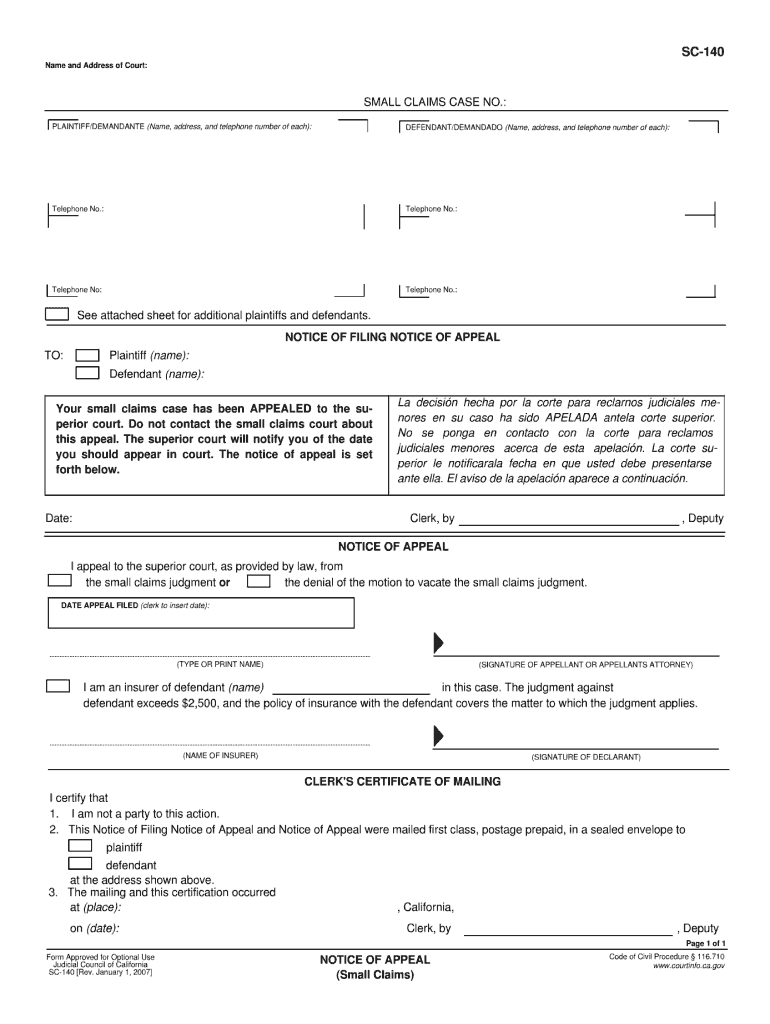

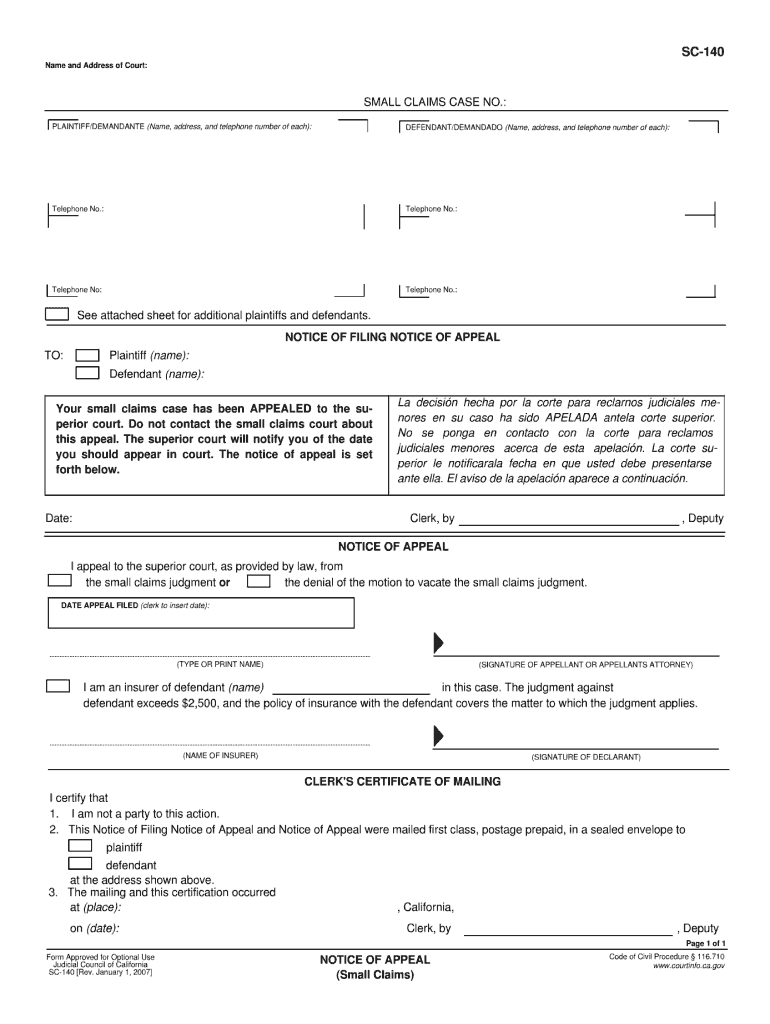

To keep other people from seeing what you entered on your form please press the Clear This Form button at the end of the form when finished. SC-140 Name and Address of Court SMALL CLAIMS CASE NO. 3. The mailing and this certification occurred at place California on date Page 1 of 1 Form Approved for Optional Use Judicial Council of California SC-140 Rev. January 1 2007 Code of Civil Procedure 116. PLAINTIFF/DEMANDANTE Name address and telephone number of each DEFENDANT/DEMANDADO Name address...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your sc 140 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sc 140 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit sc 140 online

In order to make advantage of the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit form sc 140. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

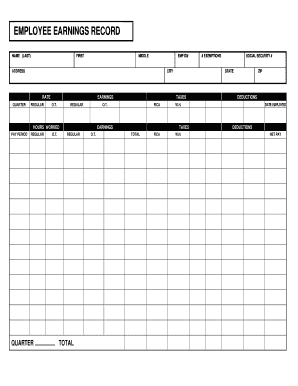

How to fill out sc 140 form

How to fill out sc 140:

01

Gather all necessary information and documents such as personal identification, income records, and any relevant supporting documentation.

02

Carefully read the instructions provided on the sc 140 form to understand the requirements and specific sections that need to be completed.

03

Begin by filling out the basic personal information section, including your name, address, social security number, and contact details.

04

Next, move on to the income section where you will disclose your sources of income, employment details, and any additional financial information required.

05

If applicable, complete any other sections or schedules that are relevant to your specific circumstances, such as deductions, credits, or exemptions.

06

Double-check all the information provided to ensure accuracy and make corrections if necessary.

07

Sign and date the sc 140 form to certify the accuracy of the information provided.

08

Make a copy of the completed sc 140 form and any supporting documentation for your records.

09

Send the original sc 140 form to the designated tax authority by the specified deadline (e.g., IRS, state tax agency).

Who needs sc 140:

01

Individuals who are required to file a state tax return in the jurisdiction that uses sc 140 as the official tax form.

02

Residents or non-residents who have earned income or have a filing requirement in the specific state.

03

Anyone who meets the eligibility criteria set by the state tax authority that necessitates the submission of sc 140.

Fill 140 court : Try Risk Free

People Also Ask about sc 140

What is an SC 105?

What is a SC 150 form?

How to file a counterclaim in small claims court California?

What happens if you lose in small claims court California?

What is a SC 150?

What is a SC 104?

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is the penalty for the late filing of sc 140?

The penalty for late filing of SC 140 is a minimum of $50 or 10% of the tax due, whichever is greater.

What is sc 140?

There is no specific context for "sc 140" provided, so it is unclear what it refers to. It could be a reference to a product code, a scientific paper, a course number, or something else entirely.

Who is required to file sc 140?

SC 140 is a form used by the California State Controller's Office for filing the Statement of Economic Interests (SEI) under the Political Reform Act. Individuals in various positions are required to file SC 140, including:

1. Statewide elected officials and judges.

2. Members of boards, commissions, and other state agencies.

3. Candidates for state offices and judicial positions.

4. Certain state employees in designated positions.

5. Local government officials, including county supervisors, city council members, and school board members, depending on the specific requirements of the local agency.

6. Certain employees of local government agencies, depending on the specific requirements of the agency.

7. Appointed officers and employees of the California Assembly and Senate.

8. Lobbyists and their employers.

This list is not exhaustive, and the specific requirements may vary depending on the jurisdiction. It is recommended to review the guidelines of the relevant agency or consult legal counsel for accurate and up-to-date information.

How to fill out sc 140?

To fill out SC 140, also known as the Petition for Simplified Dissolution of Marriage, you need to follow these steps:

1. Obtain the form: You can get the SC 140 form from the courthouse, clerk's office, or the official website of your state's judicial branch.

2. Gather necessary information: Collect all the essential details about you and your spouse that are required to complete the form. This may include your names, addresses, phone numbers, dates of marriage, and other personal information.

3. Complete the heading: At the top of the form, you need to enter the name of the county where you are filing for divorce and the case number assigned to your case.

4. Section 1: Fill in the information about you (the petitioner) and your spouse (the respondent). Include your full names, current addresses, and the date of your marriage.

5. Section 2: In this section, you need to provide details about your finances and property. List all assets (such as real estate, vehicles, bank accounts, etc.) and debts that you and your spouse have, including their estimated values.

6. Section 3: Answer all the questions in this section, declaring the reasons for your divorce, confirming that there are no minor children, consenting that the marriage cannot be saved, and acknowledging that you have reached a settlement agreement.

7. Section 4: Here, you need to provide information about any previous court cases related to your marriage, such as separations, annulments, or restraining orders.

8. Section 5: Check whether you or your spouse have completed a domestic violence prevention course or program.

9. Section 6: Sign and date the form, providing your contact information and indicating whether you have an attorney representing you or not.

10. Serving the form: Once you have completed and signed the form, make two copies. Keep one for your records and file the original with the court clerk. Serve a copy to your spouse through an authorized method, which may vary depending on your jurisdiction.

Remember that the process may vary slightly depending on your state's requirements, so it is always recommended to consult with an attorney or refer to the instructions provided with the SC 140 form for specific guidance.

What is the purpose of sc 140?

From the limited information provided, it is difficult to determine the specific context of "sc 140" and its purpose. It could refer to a wide range of things, such as a document, a product coding, a course code, a chemical compound, or any other identifier. To give a more accurate answer, please provide more context or details about what "sc 140" pertains to.

What information must be reported on sc 140?

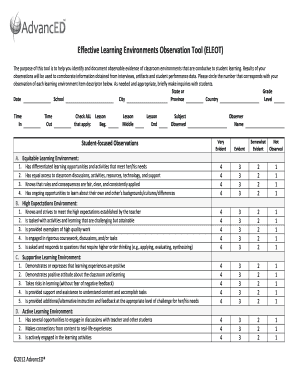

SC 140 is a reporting form used by companies to disclose information related to their corporate governance practices. The information that must be reported on SC 140 includes:

1. Board of Directors: The composition of the board, including the names, backgrounds, and qualifications of each board member. It should also include information about any changes to the board during the reporting period.

2. Board Committee Structure: Details about the various board committees, such as the audit committee, remuneration committee, and nomination committee, including the names of committee members and their specific roles and responsibilities.

3. Corporate Governance Policies: The company's corporate governance policies and practices, including any code of conduct or ethics, whistleblower policies, and related party transaction policies.

4. Shareholder Rights: Information about the company's stance on shareholder rights, including details about voting rights, the treatment of minority shareholders, and any significant deviations from recommended best practices.

5. Related Party Transactions: Disclosure of any material related party transactions, including any conflicts of interest and measures taken to ensure fairness in such transactions.

6. Board Performance Evaluation: Whether the company has conducted a formal evaluation of the board and its committees' performance during the reporting period. This report should include the criteria used for the evaluation and any actions taken based on the evaluation's results.

7. Training and Development: Details on the training and development programs offered to board members to enhance their skills and knowledge and keep them updated on corporate governance practices.

8. Risk Management and Internal Controls: Information about the company's risk management framework and internal control systems. This should include details on the processes for identifying, assessing, and managing risks and any significant internal control weaknesses identified during the reporting period.

9. Remuneration Policy: The company's remuneration policy for board members and key executives, including details about how remuneration is determined, any performance-based incentives, and any significant changes to the policy made during the reporting period.

10. Sustainability and Social Responsibility: Information about the company's sustainability practices, environmental initiatives, and social responsibility efforts.

It's important to note that the specific requirements for SC 140 reporting may vary depending on the country or regulatory authority overseeing the disclosure.

How do I edit sc 140 online?

With pdfFiller, it's easy to make changes. Open your form sc 140 in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I edit sc140 in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your how to form sc 140 fill out, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Can I create an electronic signature for the small claims notice of appeal form in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your form appeal notice in seconds.

Fill out your sc 140 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

sc140 is not the form you're looking for?Search for another form here.

Keywords relevant to sc 140 notice of appeal form

Related to sc 140 form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.